Best Microfinance Software Company in India- ( Micromuneem It Solutions Pvt Ltd )

Are you a microfinance institution (MFI) or organization looking for the perfect software solution to empower your financial services? Look no further! Our platform MicroMuneem Loan Management Software is designed to revolutionize the way you manage loans, streamline operations, and serve your clients more effectively than ever before.

At MicroMuneem Microfinance Software, we understand the unique challenges and opportunities faced by microfinance institutions. Our comprehensive software solution is tailored to meet your specific needs, enabling you to make a meaningful impact on the lives of individuals and small businesses in need of financial support.

Why MicroMuneem as your Microfinance Software?

MicroMuneem Microfinance loan management software is designed to streamline and automate the loan processes of microfinance institutions (MFIs) and organizations involved in microfinance.

Scalability and flexibility

MicroMuneem Loan management software adapts to the evolving needs of a lending institution. Whether you manage a small lending firm or a large financial institution, the software can scale to accommodate your growth.

Workflow automation

Automation of repetitive tasks like sending notifications, collecting payments, and generating loan documents saves time and resources for Microfinance Companies. This allows staff to focus on more value-added activities, such as customer service and relationship building.

Cost-effectiveness

While there is an initial investment in implementing MicroMuneem loan management software, the long-term benefits in terms of operational efficiency, reduced manual work, and risk mitigation leads to cost savings over time.

Advanced Features

ABOUT MICROFINANCE SOFTWARE

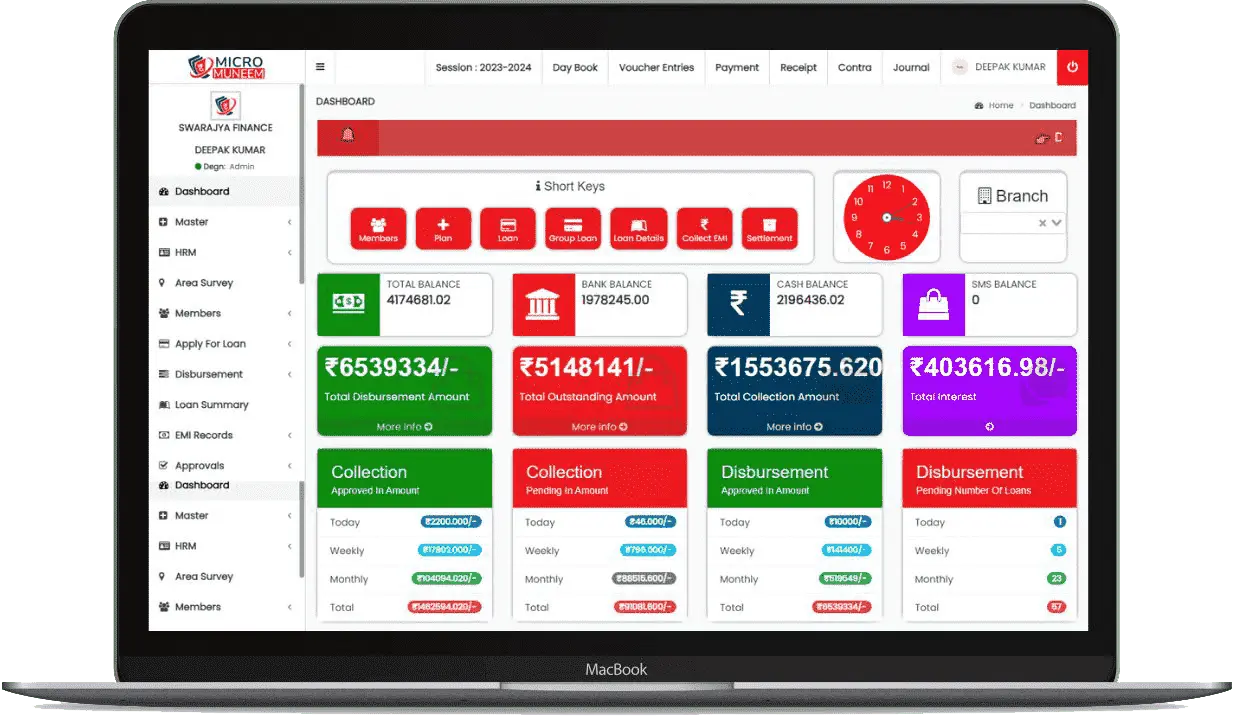

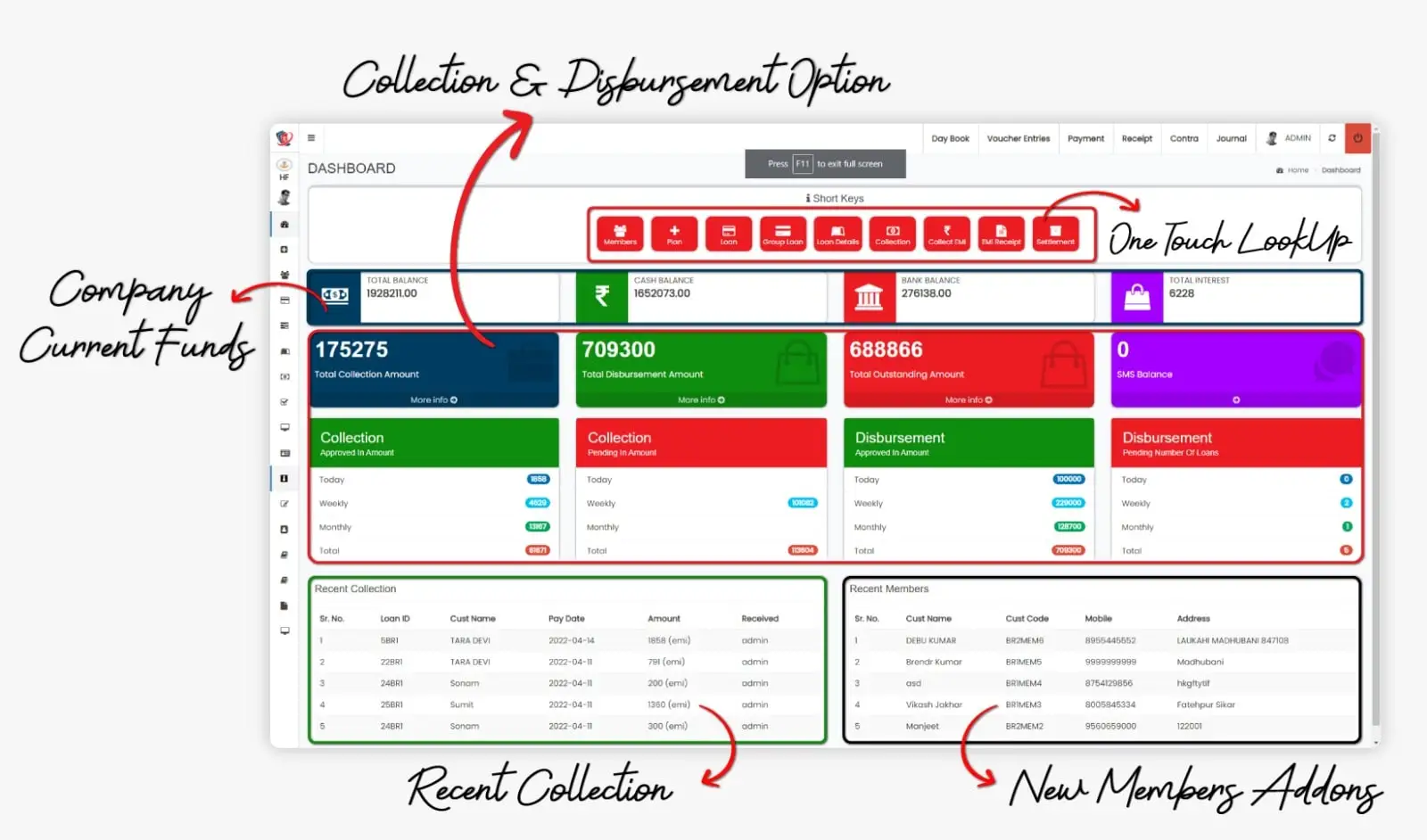

Why MicroMuneem As Loan Management Software?

-

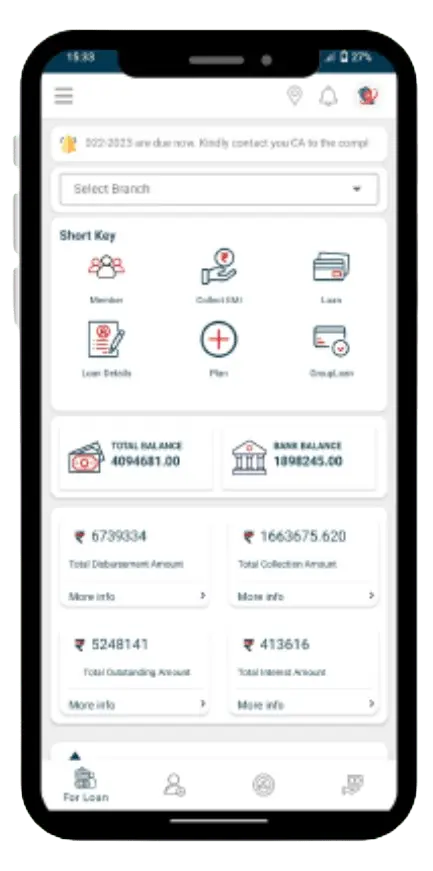

Access Data Anytime

-

Track Field Recovery Executive

-

Create Loans as per your Business Module

-

Best Security features

-

Easy Accounting

-

Profit & Loss Statement

-

Loan Transfer

-

Seamless Reporting Module

-

and much more….

Process

How to use MicroMuneem Microfinance Software?

By following these steps and leveraging the full capabilities of MicroMuneem microfinance software, your MFI can streamline operations, improve efficiency, and better serve your clients' financial needs.

-

Step 1

Add Loan Plans

Create Loan Plans based on your Microfinance Company's structure from the numerous options provided under the Loan Plan Option in the MicroMuneem Microfinance Software.

-

Step 2

Add Employee Details

Once the Loan Plans are created, you can now start enrolling your employees by filling out their information in the Employee Section in the Loan Management Software. Based on the "Role" provided, your staff can now login with the credentials assigned to them.

-

Step 3

Add Customer Details & KYC

Customer details are to be added in the Member Section in the Loan Management Software. After filling in the basic details are placed, you can upload the KYC Documents in the software itself. Once the Customer's KYC is Verified, he/she is now eligible to take a loan from your Microfinance Company.

-

Step 4

Create & Disburse Customer Loans

Use the MicroMuneem Microfinance software to process loan applications efficiently. Loan Pre-Sanction Letter, Loan Agreement Form, Loan EMI Card, and Demand Promissory Note are created once the loan is disbursed from the system.

-

Step 5

Start Collecting EMIs & Check Reports

Upon the due date, the customer's Due EMI information is shown to the assigned Employees in the EMI Records in the Microfinance Software. Your employee can collect EMIs and enter their details through the Login panel allotted to them. This makes collection efficient & easy.

Testimonial

WHAT CLIENTS SAY ABOUT US

Best Microfinance Loan Management Software

Unlocking Efficiency and Growth

Microfinance Software Features

Explore the Power-Packed Features of MicroMuneem Loan Management Software!.

Customer KYC

With Micromuneem Microfinance Software, collect and save all the customer information and KYC details at a single place.

Loan Plan

Now you can create Loan Plans as per customer requirement. Set EMI collection on a daily, weekly, bi-weekly, half month, monthly, yearly basis.

EMI Collection Report

Never miss a collection due to poor EMI collection report. Get updates on a daily basis and keep a track of the EMI due dates.

Mobile Access

You can easily access the Microfinance software anywhere with limited internet connection. Functions properly on any mobile phone.

Real-time data management

We provide a Cloud-based server for your microfinance software making it a robust, quick, & updated software. Manage your entries in real time.

Group Loan Disbursement

With the help of our Microfinance Software, distribute loans to the groups in an easier manner.

SMS Facility

SMS facility is embedded in our Microfinance software. Send conformational messages as per your requirement.

Multiple Branch

You can manage multiple branches of your Microfinance Company within a single Microfinance software.

Let's Try! Get Free Support

Start Your 7-Day Free Trial

Free Microfinance Software Demo